Having a very high Net Retention won’t (necessarily) save you...let’s dive into that fallacy

I’ve seen a few times now investors justify a high price for a moderately growing company based on NDR. The rationale being that a strong NDR indicates a high embedded value of the customer base, suggesting that even without new customer acquisition, the company would grow through expansion alone.

My main concern is that NDR isn’t consistently “re-occurring”. A one-off 20% upsell to an existing customer doesn’t guarantee repeatability. Be warry of false positives.

Investors should go deeper and understand the source of expansion - seats, pricing, new product/features adoption, penetration of new departments. The share of wallet within a client’s organisation can be limited and at that moment without your customers growing themselves (i.e. adding seats) or contractual price increases, NDR could plummet.

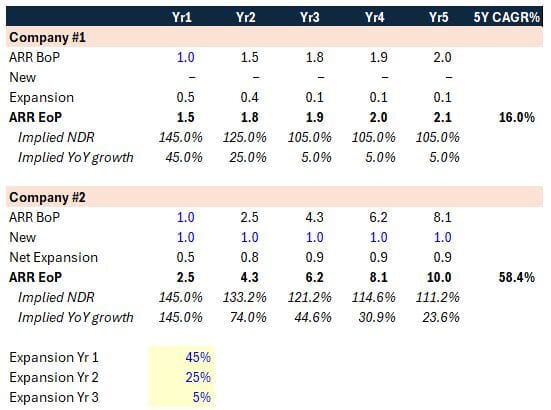

Considering company #1 below, high NDR in year 1, say 145% and decreasing in the subsequent years, not adding any new ARR. The 5-yr CAGR would be only 18% / 2.3x in the period. Your expansion generated $1.3M of ARR.

Contrast this with company #2 adding only $1M of New ARR every year. By year 5 it gets to ~10M ARR, of which $3.7M from your net expansion.

Now I know this is an overly simplistic view. It just underscores the need for investors to go through cohorts properly and get nuances about expansion during DD workshops.