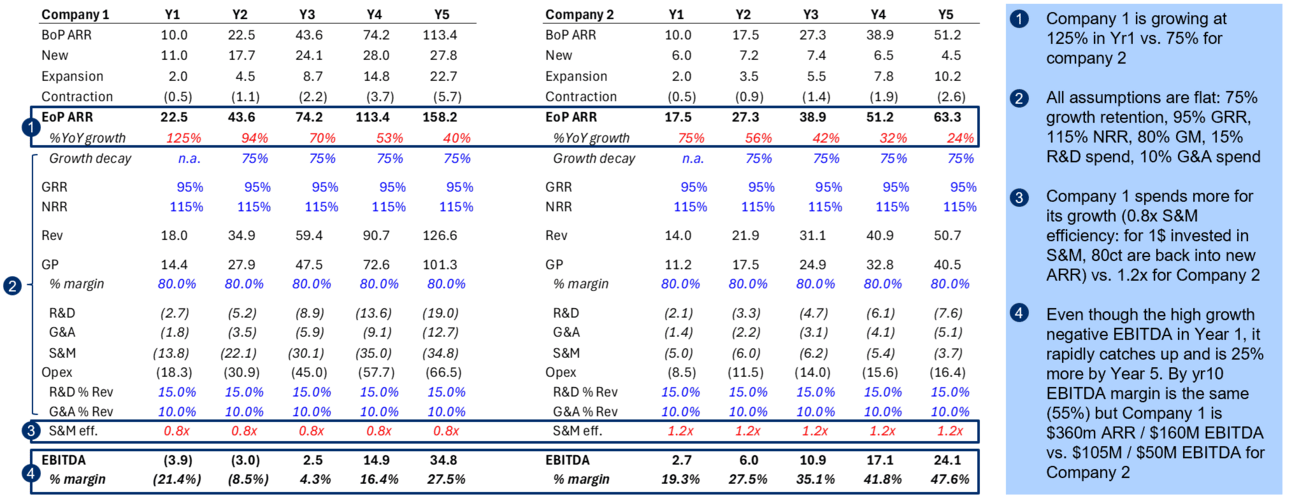

What if you had a 75% growth SaaS company making 16% EBITDA margin – but you had the potential to up growth to 125% at reasonable sales efficiency. How smart is it to grow faster?

As you can see in the above chart, with all flat assumptions (in % of revenue) except for

- growth rate: 125% vs. 75%

- S&M efficiency (new ARR / S&M spend): 0.8x vs. 1.2x

If company 1 can access sufficient capital to burn through years 1 to 3, $ EBITDA catches up in year 5 with 2.5x larger ARR.

Not only will company 1 warrant a higher valuation multiple, it will most likely be valued on a ARR multiple vs. EBITDA multiple for company #2.

If you have strong unit economics, you should be ready to look beyond short-term profitability and into embedded margin structure.